Inflation Impacts on Commercial Real Estate in Utah

On March 2, 2022 the Congressional Joint Economic Committee (CJEC) released a new report showing Utah and the Mountain West are experiencing some of the worst impacts from the recent inflation.

The study found, the Mountain West is experiencing the highest inflation in the country with an annual rate of 9.0 percent, largely driven by rising home and rent prices.

Experts say home prices are up 30%, while rent, is about 10-15% higher on a year over year basis.

Inflation is also impacting the commercial real estate industry in Utah specifically average lease rate growth.

“Inflation has a huge impact on commercial real estate,” Mountain West Managing Director Chad Moore said. “Value of property continues to rise, making it more expensive to purchase. Construction costs continue to climb making it harder to build anything”.

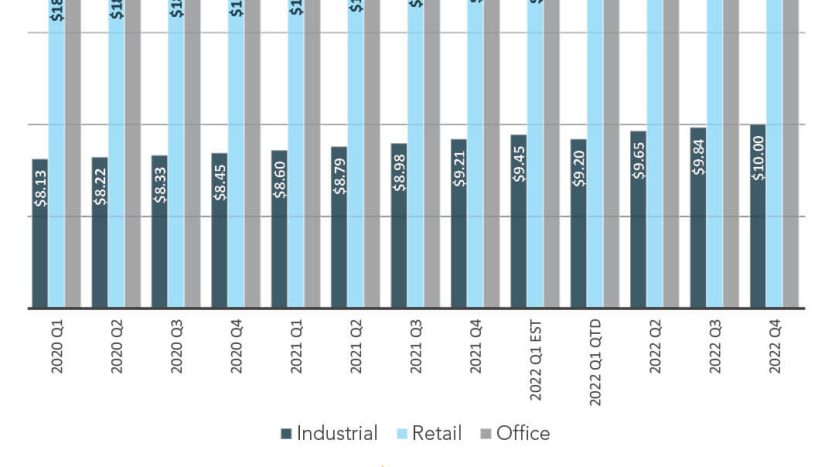

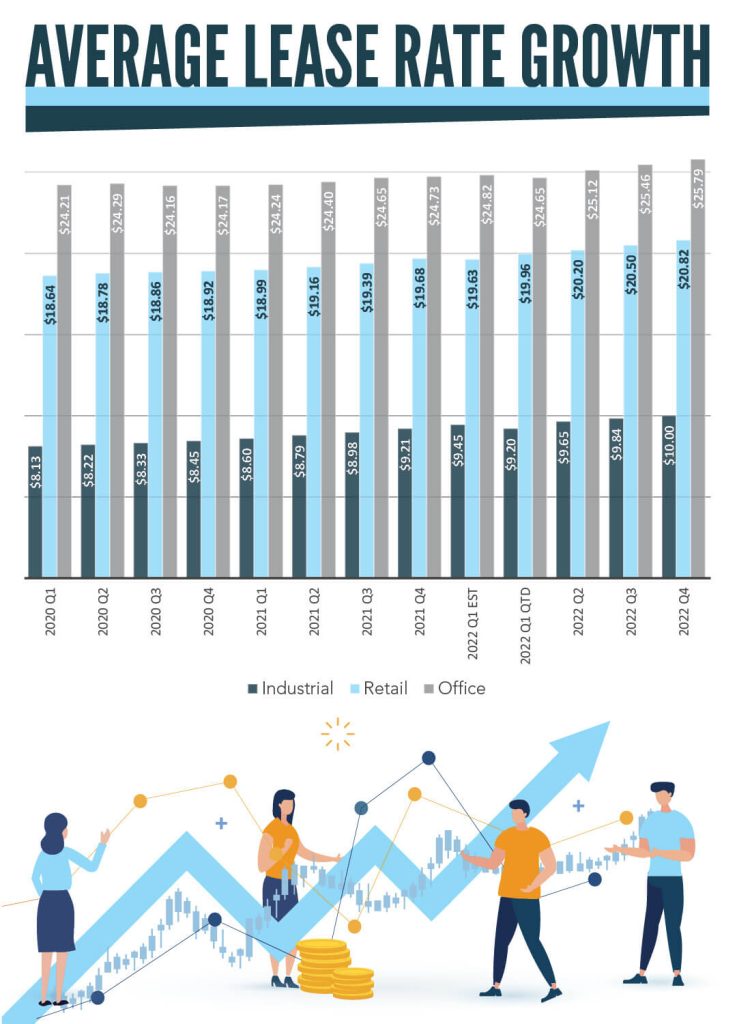

According to researchers at Mountain West Commercial Real Estate, over the past three years, the price per square foot for industrial, retail, and office properties has steadily increased but since the beginning of the COVID-19 Pandemic, price increases are more apparent than ever.

New numbers show, from Q1 2020 to Q4 2021 the cost per square foot for industrial properties in the 8 states that comprise the Mountain West Region went from $8.13 to $9.21 which is a 13.28% increase. Mountain West estimates for Q1 2022 the cost per SF will be $9.45 which is a 2.61% increase from Q4 2021.

From Q1 2020 to Q4 2021, the price per square foot has increased 5.58% for retail properties. For office spaces the price per square foot has increased 2.15% over the same period.

According to the study from the CJEC, inflation rates jumped 7% and Utah families are spending $511 more per month than they did compared to this time last year.

Experts say there is no telling if or when these rates will start trending downward.

Gas Prices on the Rise

According to current brent crude oil prices Oil prices have surged roughly 25% since Russia’s invasion of Ukraine and have traded around $113 a barrel. Gas prices in Utah are above $4.00 a gallon and in parts of California in some cases it is more than $2.00 higher.

According to analysts at Goldman Sachs, near-term crude oil and agricultural commodity forecasts imply an effective 0.7% drag on real disposable income that will weigh on spending in 2022. We also expect modest drags on growth from further tightening of financial conditions, lower consumer sentiment, and slower growth in Europe, and see additional downside risks if shortages of key metals constrain U.S. production.

Fear of Recession

Goldman Sachs Chief Economist Jan Hatzius says there is now a risk that the U.S. could enter a recession by the end of 2022.

““The Russia-Ukraine conflict has dented our previously optimistic views on Europe’s economic and asset market outlook,” said Goldman Sachs Chief Economist Jan Hatzius. “As broadly in line with the 20-35% odds currently implied by models based on the slope of the yield curve”.

Hatzius says his 2022 U.S. GDP forecast to a growth of 1.75% from 2% previously. Consensus estimates are looking for a 2.7% increase.