Will Cap Rates Expand?

Background

The potential for cap rate expansion is unclear as cap rates are continuously changing. According to First National, Cap rate expansion means cap rates are going up and property value is coming down. Office, retail, and hospitality properties are included in the group that relies on cap rates to estimate property value. A result of the pandemic is so many workers are working remotely at home, and many large office properties were empty during the height of the pandemic. Although most of these businesses paid the rent, according to Mountain West occupancy on many office properties fell to 85% or below in Utah and across the nation. During this time of uncertainty property values came down. This caused some tenants to have some hesitation to sign long-term leases creating tenant rollover risk for lenders. This meant someone interested in buying for example an office property would have to put a lot more down and most likely must use more expensive financing.

Not only office properties but retail properties were also impacted by the pandemic. The amount of customers shopping had already been negatively impacted by the various online shopping trends. The uncertainty in this sector created by online shopping had changed leasing habits for retail tenants, specifically restaurants and apparel stores who did not sign longer-term leases, again creating tenant rollover risk.

Initially, hotels were hit hard by the pandemic due to people traveling less. Mountain West’s hospitality brokers say says this caused operators to make special arrangements with their lenders and greatly increased lender risk.

Will Cap Rates Expand?

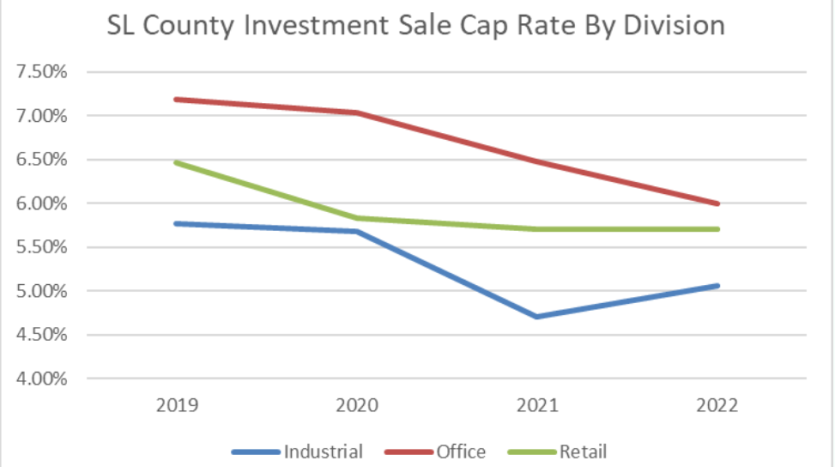

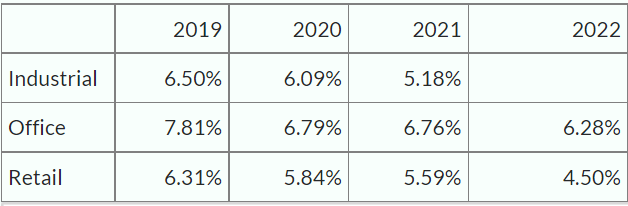

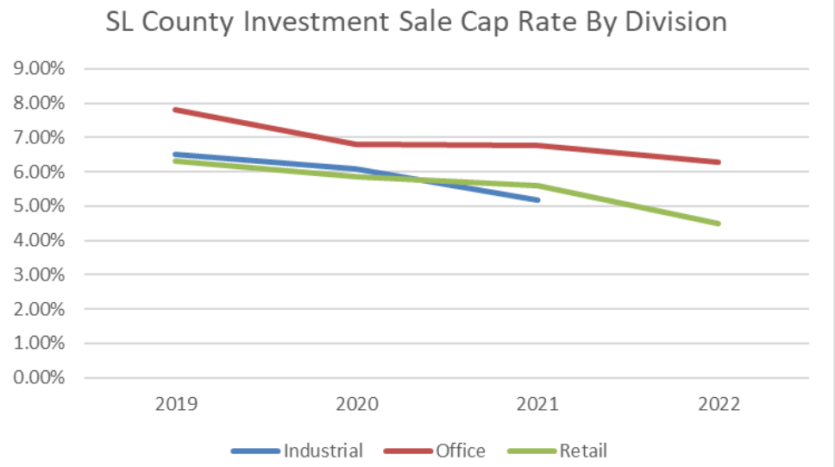

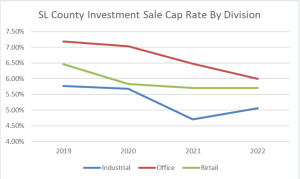

In two of Mountain West’s major markets researchers are beginning to see cap rates stabilize. In Salt Lake County we looked at investment sale cap rates for office, retail, and industrial properties. Right now, we a seeing cap rate expansion in the industrial property space representing low property prices. Cap rates were at their lowest in 2021 compared to the previous two years. And in Utah County, cap rates are at an all-time low representing higher property prices in the area. Our brokers say right now it is unclear whether there is a potential for further cap rate expansion.

Rising Interest Rates: As a general rule of thumb, cap rates tend to go up when interest rates rise. This movement reflects the increased cost of borrowing, which means that returns also need to rise in order to maintain the same level of profitability. To achieve higher returns, property prices have to fall.

Excessive Supply: If the market is flooded with excess supply, it would be normal for rental rates to fall in response. Falling rental rates increase the risk associated with a property so returns need to rise to compensate investors for the increased risk.

Macroeconomic Conditions: If the outlook for the economy, in general, is poor, cap rates tend to rise. In particular, certain data points like job growth, wage growth, unemployment, and inflation, are strong predictors of deteriorating economic conditions. Any type of economic uncertainty increases risk, which causes cap rates to rise.