Reviving Commercial Real Estate in 2024: 3 Reasons for Optimism

In the ever-evolving landscape of commercial real estate (CRE), 2023 witnessed a 21% decline in sales compared to the robust period of 2014-2019. However, as we step into 2024, there are three significant factors that could spark a revival in CRE activity.

“The market has been in a standstill for most of 2023 as investors wait to see the dust settle after the many rate hikes from the Feds. I’m excited by the prospects for 2024 and feel that more investors will come back to the market after being sidelined, particularly with forecasted declining interest rates in 2024,” said Irwin Laroza, Senior Director, Capital Markets.

1) Inflationary Pressures Easing:

One of the primary contributors to the CRE slowdown in 2023 was the lingering inflationary pressures that cast a shadow over the market. However, the winds of change are palpable as we find ourselves on the backside of the inflation curve. Virtually all inflationary measurements are displaying significant declines, instilling confidence in the market. Job creation, albeit slower in the past year, remains positive with a forecast of 1.7 million jobs in 2024, and unemployment is expected to stay at a low 4%. Various indicators such as Core Retail Sales, Service Index Consumer Index, and corporate profits also reflect modestly positive trends, creating a favorable environment for CRE resurgence.

Keep an eye out for the release of inflation data over the next few months; these pivotal months will hold the key to understanding how interest rates will move in 2024.

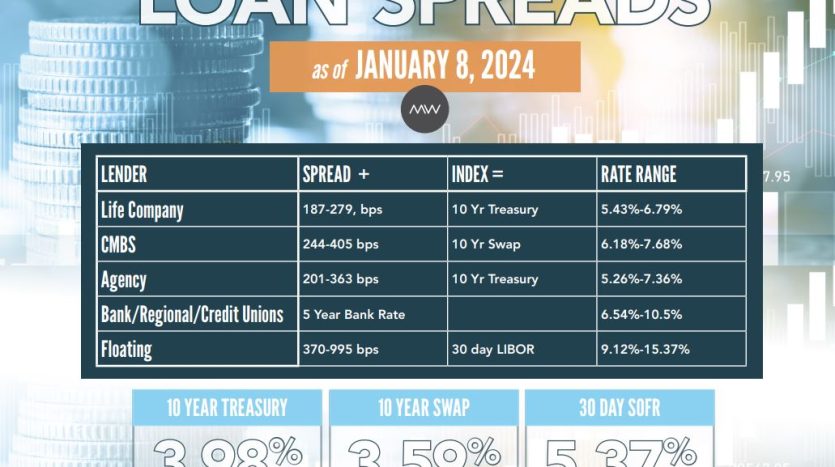

As interest rates begin to come down, borrowing costs decrease, making investments in real estate more attractive. This positive development aligns with the broader economic picture and sets the stage for renewed enthusiasm in the commercial real estate market.

2) Maturing Debt Forcing Activity: The commercial real estate market is facing a significant challenge with nearly $1 trillion in loans maturing by the end of 2024, escalating to potentially $2.5 trillion by the end of 2027. Property owners with maturing debt will need to refinance debt at higher interest rates, sell or make other arrangements with lenders. Banks, particularly regional banks, that have offered a significant amount of the CRE debt since the GFC are somewhat reluctant to add additional CRE debt to their balance sheets. This lack of liquidity from some lenders has prompted a surge in mezzanine debt and preferred equity deals, particularly from the middle market, offering a lifeline for borrowers to bridge their liquidity gaps.

3) Abundance of Capital Waiting to be Deployed:

Behind the scenes, a substantial volume of capital is eagerly waiting to be deployed into the market. The pent-up demand for CRE investments suggests a latent energy that, when unleashed, could drive a surge in transactions and propel the market forward. This influx of capital signifies the confidence investors have in the sector’s potential for growth and stability.

The stage is set for a revival in commercial real estate in 2024. The combination of easing inflationary pressures, declining interest rates, and a surplus of capital awaiting deployment paints an optimistic picture for the industry. As we eagerly await the release of inflation rates over the next few months, the potential impact on interest rates in 2024 adds an intriguing element to the unfolding narrative. Stay tuned for more insights as we navigate the evolving landscape of commercial real estate in the coming months.