Subway’s $9.6 Billion Deal with Roark Capital: Implications for Utah’s Commercial Real Estate

In a move that has sent ripples through the commercial real estate industry, Subway recently announced its agreement to be acquired by Roark Capital for a staggering $9.6 billion. This transaction, the largest in the restaurant sector since Inspire Brands’ acquisition of Dunkin’ and Baskin-Robbins, is making headlines and raising questions about its potential impact on the commercial real estate landscape, particularly in Utah.

Roark Capital’s extensive portfolio includes well-known brands like Buffalo Wild Wings, Jimmy Johns, Dunkin’, Carl’s Jr., and more, making Subway a strategic addition to its collection.

Subway’s Long-Term Growth Potential

Subway CEO John Chidsey said the deal reflects Subway’s long-term growth potential and the substantial value of the brand and its franchisees worldwide. While this acquisition is poised to reshape the fast-food giant, the broader implications for commercial real estate remain speculative but promising.

Utah’s Commercial Real Estate Market: A Close Watch

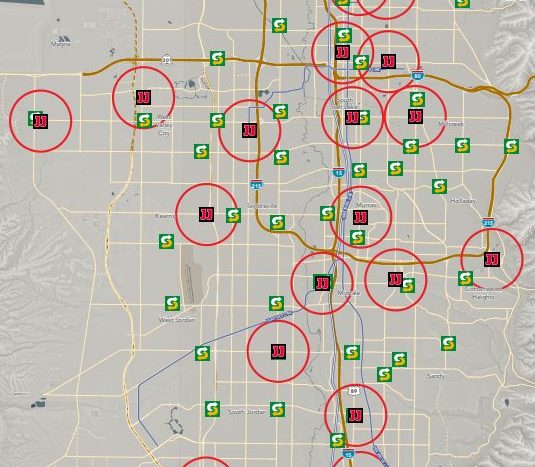

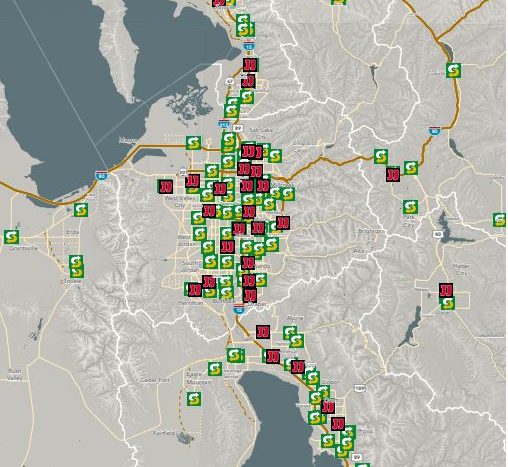

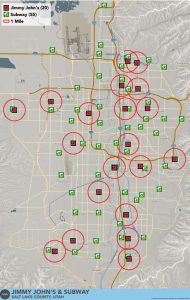

With Subway being one of the globe’s largest restaurant networks, boasting nearly 37,000 outlets worldwide and approximately 20,000 in the U.S. alone, Utah’s commercial real estate industry may find new leasing opportunities on the horizon. Subway’s growth strategy has emphasized optimizing trading locations, which could increase leasing demands in various commercial spaces across the state. Although the implications are unknown, experts at Mountain West Commercial say low performing stores near each other could create future leasing opportunities. Across Salt Lake, Utah, and Weber/Davis Counties are 133 Subways and 40 Jimmy Johns locations. In Salt Lake County, 20 Jimmy John locations are less than a one-mile radius of 21 Subway locations. Throughout the states were Mountain West Commercial Real estate predominantly conducts business (ID, NV, MT, WY). There are 77 total Jimmy Johns and 428 Subways.

Subway’s Transformative Initiatives

Subway’s extensive transformation plan includes upgrading its restaurants to the “Fresh Forward” design, with modern features and aesthetics. This could spur renovations and remodeling projects, driving the demand for commercial real estate services in Utah’s construction and renovation sectors.

Moreover, Subway’s goal of increasing North American openings by 35 percent in 2023 might expand its restaurant footprint, further fueling the need for commercial real estate services.

Subway’s Reshuffling and Financial Records

Subway’s leadership reshuffle, including Trevor Haynes’ departure and key executive promotions, signals a period of change and potential expansion. This changing landscape may shift office space requirements, providing opportunities for commercial real estate professionals in Utah to assist with these transitions.

Subway’s recent financial performance, with record-breaking figures and consistently positive momentum, reflects a brand on the rise. As Subway grows, so too may the need for additional commercial spaces, from corporate offices to retail locations.

Looking Ahead

While Subway’s acquisition by Roark Capital has great promise, it’s important to remember that the full impact on Utah’s commercial real estate market remains to be determined. However, this monumental deal has the potential to open new leasing opportunities and create ripple effects in various sectors related to commercial real estate.

As we continue to monitor this situation, it’s evident that Utah’s commercial real estate industry should prepare for potential shifts and opportunities in the wake of Subway’s transformation under Roark Capital’s ownership.

The acquisition timing is subject to regulatory approvals and customary closing conditions.